WHAT’S CHANGED?

SOFTWARE SPEND IS UNDER NEW LEVELS OF SCRUTINY IN THE ERA OF AI

Hitting The Tech Stack

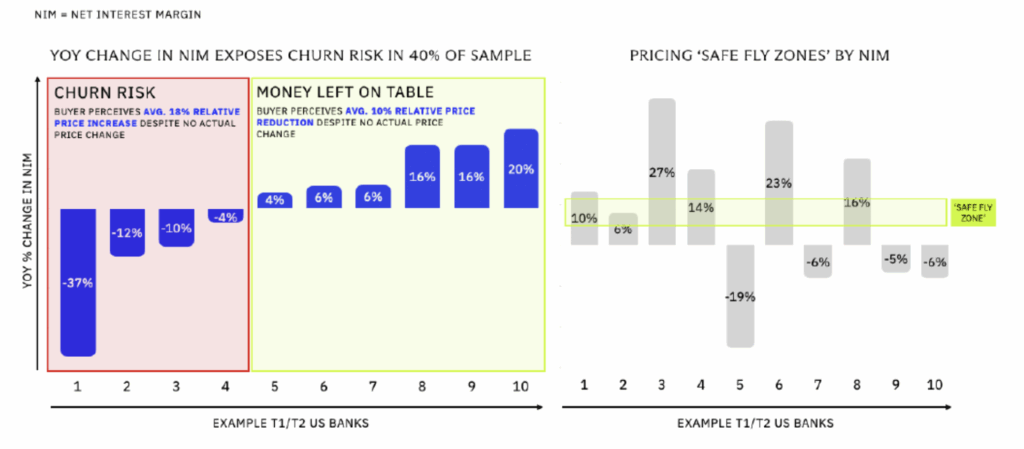

Commercial lending net interest margin (NIM) is down 2.56% and cost of deposit has risen by up to 33%. As the bottom-line shrinks, new tech-stack spend is bottom of the list.

The centre of gravity is shifting from features to decisioning. Customers now expect platforms to guide them, not just give them access.

Buyers are sharper than ever. Centralised teams, public benchmarks, and long memories of failed rollouts have left heavy scepticism and hard negotiation.

HOUSE VIEW:

WHAT THIS MEANS FOR PRICING

Per-user pricing is dying. Delaying the move can cost 12% ARR growth per year.

As AI becomes table-stakes and teams are slimmed down (HSBC, Citigroup, JPM all reducing headcount by 3–10%), FinTechs must rethink how they scale with customers to protect ARR.

User-based approaches don’t remotely proxy your customers’ bottom line.

Tying price to pure results still misses the point. Buyers must balance poor value communication, risk budgets and an army of indirect competition.

We’re consistently seeing willingness-to-pay at <5% of proven returns.

Yes, that’s 20X ROI.

We’re in a buyer’s market, and expectations have shifted. It’s on you to tell the buyer what they need. Decision-makers are demanding use-case-level solutions and the ability to ‘slide down’ offerings to fit their tech stack.

The good news is getting this right delivers fresh upsell pathways. We’re seeing 20PP+ increases in NRR.

SEE IT IN ACTION:

SHIFT IN CUSTOMER PROFITABILITY EXPOSES CHURN RISK FOR BANKING SAAS

SO WHAT?

THE THREE QUESTIONS TO ASK YOUR TEAM

How has our customers’ profitability shifted in the last three years? How does this translate as a ‘perceived price change’ for them?

Where are the pockets of churn risk and money left-on-table in our portfolio?

Are we lagging or leading in matching our packages to customer pain and flexibility demands?